According to Kai Hattendorf, managing director and CEO at UFI, the bounce-back of exhibitions around the world has entered its next phase, and pre-COVID levels will be within reach as early as next year in some markets. “As the industry manages this amazing recovery, it is also dealing with significant staffing challenges and is working to apply key learning from the pandemic around the digitization of events and services into its business model,” Hattendorf said.

Here are some highlights from the report:

- In terms of operations, around six in 10 companies are reporting “normal activity”—up from just three in 10 six months ago. By the end of 2022, seven in 10 companies expect to be operating at normal levels, while only around 5% of companies still expect to have “no activity” from September 2022.

- When asked what elements are most crucial to supporting the “bounce-back” of exhibitions, six in 10 companies selected “Lifting of current travel restrictions” and “Readiness of exhibiting companies and visitors to participate again.”

- As the two next most influential drivers, “Financial incentive packages (leading to reduced costs for exhibitors)” and “Lifting of current public policies that apply locally to exhibitions” were mentioned by four in 10 and three in 10 companies, respectively.

- In terms of 2022 operating profits, 25% of companies globally are expecting either a loss or a reduction of more than 50%, compared to 2019 levels. Overall, 73% of companies received no public financial support during the pandemic, and for the majority of those that did, financial public aid represented less than 10% of their overall costs.

- The most pressing business issues reflect how the industry is currently focusing on post-pandemic challenges and opportunities, with “Internal management challenges” (highlighted by 20% of respondents), “Impact of digitization” (17%) and “Competition with other media” (15%) as the most common.

- Meanwhile, the “Impact of the COVID-19 pandemic on the business” dropped from being the most pressing business issue to the sixth-most pressing issue (a drop from 19% to 11%), compared to the previous edition of the barometer.

Reopening Exhibitions, Turnover, Operating Profits and Financial Support

Standing out as markets where the majority of companies returned to normal activity levels in early 2022 are Spain, Turkey and the UK in Europe; Saudi Arabia and the UAE in the Middle East; and Australia and Brazil. Globally, the majority of markets reached this point in March 2022.

Notably, as a region, Asia only reached this point in May (with China not expecting to reach this point until October and Hong Kong not until next year).

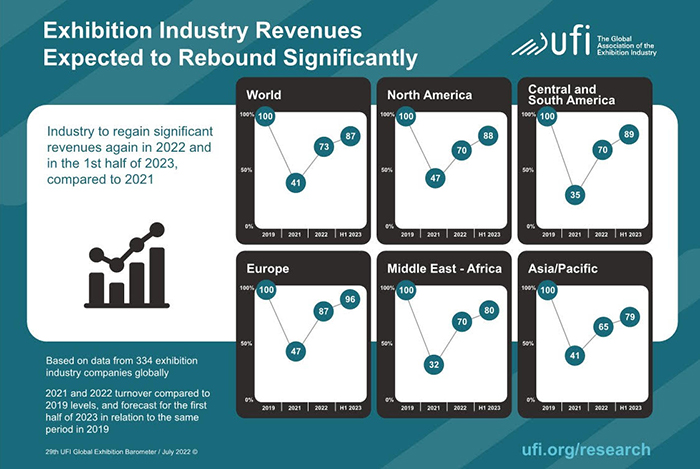

Globally and on average, companies have seen a significant increase in their 2022 turnover, representing 73% of 2019 levels. They also project this to increase to 87%, using the same baseline for the first half of 2023.

For 2022 revenues, many countries are performing well above average, including:

- UK (89% of 2019 levels)

- Italy (86%)

- Saudi Arabia (85%)

- Turkey and South Korea (82%)

- Japan (80%)

Contrasting this are the results from Hong Kong (34% of 2019 levels), China and South Africa (both at 57%), and Malaysia (59%).

For projected revenues for the first half of 2023, most markets are expecting at least 75% of 2019 levels, with only Hong Kong (58%) China (69%) and South Africa (72%) expecting lower levels.

In terms of operating profit for 2022, 10% of companies globally are expecting a loss, and 15% are expecting a reduction of more than 50%, compared to 2019 levels.

Several regions include countries with a higher-than-average proportion of companies foreseeing a loss in 2022. They include:

- Brazil (13%) in Central and South America

- Germany (15%) and Italy (13%) in Europe

- Australia (14%)

- China (21%)

- Hong Kong (20%)

- India (17%)

- Singapore (20%)

- South Korea (11%) and Thailand (40%) in Asia-Pacific

In terms of public financial support, Asia-Pacific and Europe experienced the highest proportions of businesses receiving this funding (37% and 35% respectively).

In all regions, there are significant differences across markets, as can be seen in the following percentage ranges of companies declaring they received “no public support”:

- from 10% in Hong Kong to 92% in India (Asia-Pacific)

- from 38% in Germany to 86% in Turkey (Europe)

- from 58% in Colombia to 100% in Chile (Central and South America)

- from 69% in Saudi Arabia to 100% in the UAE (Middle East and Africa)

Key Industry Challenges and Business Issues

According to the survey, management challenges (such as staffing and digitization) are the most pressing industry issues at this time, with 69% of companies currently undergoing recruitment drives

Globally, 69% of exhibition companies are currently undergoing staff recruitment drives, with 62% facing challenges in sourcing the appropriate candidates. In all regions, most companies are working to recruit more staff, while at the country level, China is the only country where a majority of companies are not recruiting.

As far as digitization, 65% of respondents said they have added digital services and products (such as apps, digital advertising and digital signage) to their existing exhibition offerings, especially in the Asia-Pacific region (71%).

Additionally, while 49% of global respondents indicated they have digitized internal processes and workflows, this number was higher in the Middle East and Africa (62%) and Europe (55%).

While 32% of global respondents said they have developed a digital or transformation strategy for exhibitions and products, this number was higher in Central and South America (38%).

Overall, “Internal management challenges” is the key business issue for all regions and the most selected issue for most markets, with staffing being the most prevalent challenge.

Some differences can be seen related to “Impact of digitization,” which is the most pressing issue in Colombia (24%) and Germany, followed by Malaysia and Thailand (20%). Meanwhile, “Impact of the COVID-19 pandemic on the business” remains the top business issue in China (21%) and Hong Kong and Japan (20%).

An analysis by industry segment (organizer, venue and service provider) demonstrates no differences in regards to the three most important issues: “Internal management challenges,” “Impact of digitization” and “Competition with other media.”

Future Exhibition Formats: In-Person and Digital Events

In addition to the 87% of companies that are confident that “COVID-19 confirms the value of face-to-face events”:

- 31% (compared to 44% in the previous edition, and 46% in the edition prior to that) believe there will be “Less international ‘physical’ exhibitions and, overall, less participants” (with 4% stating “Yes, for sure”, 27% stating “Most probably” and 26% remaining unsure).

61% (compared to 73% and 76% previously) believe there is “A push towards hybrid events, more digital elements at events” (with 19% stating “Yes, for sure”, 42% stating “Most probably” and 20% remaining unsure).

61% (compared to 73% and 76% previously) believe there is “A push towards hybrid events, more digital elements at events” (with 19% stating “Yes, for sure”, 42% stating “Most probably” and 20% remaining unsure).- 6% (compared to 10% and 14% previously) agree that “Virtual events are replacing physical events,” with 16% being unsure and 57% stating “Definitely not.”

The results are similar across regions, with the exception of a significantly higher proportion of companies in Central and South America (35%) being “unsure” that “Virtual events are replacing physical events.”

The complete barometer report includes dedicated profiles for 28 markets and regions, as well as a list of the 19 UFI member associations that helped conduct the survey. Download the full results here.

The next UFI Global Exhibition Barometer survey will be conducted in December 2022.