Sales forecasting can play a major role in your company's success (and your own career development). According to research from the Aberdeen Group, companies with accurate sales forecasts are 10% more likely to grow their revenue year-over-year and 7.3% more likely to hit quota. But despite the advantages, many sales leaders struggle to create sales forecasts that are anywhere near reality. We've compiled an in-depth guide to creating a trustworthy sales forecast -- rather than a wish-cast. Read on to learn:

Sales Forecasting

A sales forecast predicts what a salesperson, team, or company will sell weekly, monthly, quarterly, or annually. Managers  use reps' sales forecasts to estimate business their team will close. Directors use team forecasts to anticipate department sales. The VP of Sales uses department forecasts to project organization sales.

use reps' sales forecasts to estimate business their team will close. Directors use team forecasts to anticipate department sales. The VP of Sales uses department forecasts to project organization sales.

These reports are typically shared with company leadership, along with board members and/or stockholders.

Why Is Sales Forecasting Important?

Sales forecasts allow you to spot potential issues while there's still time to avoid or mitigate them. For example, if you notice your team is trending 35% below quota, you can figure out what's going on and course-correct. Maybe your competitor has started an aggressive new discounting campaign, or your new sales comp plan unintentionally encourages bad behavior.

Discovering these problems now -- versus at the end of the month or quarter -- has a huge impact.

Sales forecasts also come into play for a number of decisions, from hiring and resource management to goal-setting and budgeting.

Suppose your sales forecast predicts a 26% increase in opportunities. To make sure you're keeping up with demand, you should start recruiting. If opportunities are predicted to go down, on the other hand, it would be wise to pause your hiring efforts. Simultaneously, look at bumping up marketing spend and investing in prospecting training for your reps.

In addition, a sales forecast is a powerful motivation tool.

For example, each week you might update your quarterly sales forecast to see if your team is on track to hit its target. You could also create a forecast every day for an individual sales rep on a performance plan to make sure he's not falling behind.

One of the most important points to remember about sales forecasts: They don't need to be perfect to be valuable. Your sales forecast will often, if not always, be slightly different from your results. Of course, wildly inaccurate results are problematic -- but if you're using clean data and have chosen the right method (which we'll get to), your sales forecast will help you both plan and drive growth.

What You Need for a Sales Forecast

An accurate sales forecast requires the following elements:

- Individual and team quotas: To gauge performance, you need an objective definition of "success."

- A documented, structured sales process: If your reps aren't consistently using the same stages and steps, you won't be able to predict the likelihood of an opportunity closing.

- Standard opportunity, lead, prospect, and close definitions: Everyone needs to agree about when and how to count leads entering and exiting the funnel.

- A CRM: Reps need a database for tracking opportunities to give you accurate close predictions.

- Accountability: When a salesperson misses their forecast, do you follow up to figure out why? If not, you're implying forecasts don't need to be grounded in reality.

Common Factors Impacting Your Sales Forecast

Watch out for these factors, which you'll need to account for in your forecast.

Internal Factors:

Hires and fires: When salespeople leave your company -- either because they quit or were terminated -- revenue will decrease unless you have a pipeline of potential hires. If a significant number of reps came on board at one time, your sales forecast should predict a big jump in business when they've ramped.

Policy changes: Don't adjust your sales comp plan without adjusting your forecast. If you implement a four-month clawback on commissions, for example, revenue will decrease because your reps will only sell to best-fit prospects. However, in a quarter when far fewer customers churn, your profits will increase.

Or perhaps you say reps can't discount after the 15th of every month. You'll see a spike in close rates in the first two weeks, followed by fewer sales than normal.

Territory shifts: It takes time for reps to familiarize themselves with a new territory and build their pipeline, so expect your close rate to dip before picking up again (assuming you planned your new territories well).

External Factors:

Competitive changes: Unsurprisingly, what your competitors are doing will impact your win rates. If another company in the space slashes their prices, your reps may need to discount more aggressively or risk losing business. If a competitor goes out of business, on the other hand, you'll probably see increased demand.

Economic conditions: When the economy is strong, buyers are more likely to invest in their businesses. When it's weak, the sales cycle usually takes longer and there's a greater level of scrutiny for every purchase.

Market changes: Stay on top of what's happening with your buyer's customers. For example, if you sell consulting services to hotels, you'd be interested in an anticipated rise in tourism.

Industry changes: If a complementary solution sees unexpectedly high demand, you'll probably see your sales go up too. Imagine you sell jelly. The more peanut butter people buy, the more jelly they'll buy as well.

Legislative changes: New laws and mandates can either help or hurt your business -- either by creating demand for your product or making prospects reluctant to buy anything new.

Product changes: Are you rolling out a highly-requested feature, introducing a new pricing model, or offering a complementary product or service? These changes can help your salespeople increase their average deal size, shorten their sales cycle, and/or win more business.

Seasonality: Your customers might be more likely to buy at certain times of the year. For instance, school districts typically assess new purchases in spring and decide what to buy in fall.

How to Forecast Sales

- Opportunity Stage Forecasting

- Length of Sales Cycle Forecasting

- Intuitive Forecasting

- Historical Forecasting

- Multi-Variable Forecasting

- Pipeline Forecasting

Not all sales forecasting methods are created equal. Here are a few of the most common ways to forecast sales.

1. Opportunity Stage Forecasting

This method accounts for the various stages of the sales process each deal is in. The further along in the pipeline, the likelier a deal is to close; for example, you may find prospects who schedule an initial discovery call are 10% likely to become customers, while those who make it to the demo stage are 30% likely.

Once you've picked a reporting period -- usually month, quarter, or year, depending on the length of your sales cycle and your sales team's quota -- you simply multiply each deal's potential value by the probability it will close. To illustrate, a $1,000 deal is 40% likely to close, your forecasted amount would be $600.

After you've done this for each deal in the pipeline, add up the total to get your overall forecast.

Although it's relatively easy to create a sales forecast this way, the results are often inaccurate. This method doesn't account for the age of an opportunity. In other words, a deal that's been languishing in your rep's pipeline for three months will be treated the same as one that's a week old -- as long as their close dates are the same. You have to trust your salespeople to regularly clean up their pipelines, which isn't always feasible.

This type of forecast also may rely too heavily on historical data. If you're changing your messaging, products, sales process, or any other variable, your deals will close at different percentages by stage than they have in the past. And if you don't have much data to go off of, you're essentially guessing.

2. Length of Sales Cycle Forecasting

This forecasting method uses the age of individual opportunities to predict when they're likely to close. For instance, if the average sales cycle lasts six months, and your salesperson has been working an account for three months, your forecast might suggest they're 55% likely to win the deal.

Because this technique relies solely on objective data rather than the rep's feedback, you're less likely to get a prediction that's too generous. Suppose a salesperson books a demo with a prospect before they're ready. They might tell you the prospect is close to buying -- but this method will calculate they're unlikely to buy because they only started talking to the salesperson a few weeks ago.

Furthermore, this technique can encompass different sales cycles. A normal lead might take roughly six months to buy, but referrals could typically need only one month, and leads coming from trade shows may require approximately eight months. You can bucket each deal type by average sales cycle length.

To get accurate results, you'll need to carefully track how and when prospects enter your salespeople's pipelines.

If your CRM doesn't integrate with your marketing software as well as automatically log interactions, your reps will be spending a lot of time manually entering data.

3. Intuitive Forecasting

Some sales managers simply ask their reps to estimate likelihood of closing. The salesperson might say, "I'm confident they'll buy within 14 days, and the deal will be worth X."

On the one hand, this method factors in the opinions of the ones closest to prospects: Your salespeople. On the other, reps are naturally optimistic and often offer overly generous estimates.

There's also no scalable way to verify their assessment. To see whether a prospect is as likely to close as the salesperson says, her sales manager would need to listen to her calls, shadow her meetings, and/or read her conversations.

This method is most valuable in the very early stages of a company or product, when there's close to zero historical data.

4. Historical Forecasting

A quick and dirty way to predict how much you'll sell in a month, quarter, or year is to look at the matching time period and assume your results will be equal to or greater than those results.

For instance, if your team collectively sold $80,000 in monthly recurring revenue (MRR) in October, you'd assume they'd sell $80,000 or more in November.

You can make this prediction more sophisticated by adding your historical growth. Let's say you consistently increase sales by 6-8% each month. A conservative estimate for November would be $84,800.

There are a few issues with this method. First, it doesn't take into account seasonality. If November is a bad month for sales across the industry, you might end up only selling $70,000 in MRR.

Second, it assumes that buyer demand is constant. But if anything outside of the ordinary happens, your model won't hold up.

Ultimately, historical demand should be used as a benchmark rather than the foundation of your sales forecast.

5. Multi-Variable Analysis

The most sophisticated forecasting method uses predictive analytics and incorporates several of the factors mentioned, such as average sales cycle length, probability of closing based on opportunity type, and individual rep performance.

Here's a simplified example to illustrate: Imagine you have two reps, each of which is working a single account. Your first rep has a meeting with Procurement scheduled for Friday, while your second rep just gave her first presentation to the buying committee.

Based on your first rep's win rate for this stage of the sales process, combined with the relatively large predicted deal size and the number of days left in the quarter, he's 40% likely to close in this period. That gives you a forecast of $9,600.

Your second rep is earlier in the sales process, but the deal is smaller and she has a high close rate. She's also 40% likely to close, giving you a forecast of $6,800.

Combine those, and you'd get a quarterly sales forecast of $16,400.

This forecast tends to be the most accurate. However, it requires an advanced analytics solution, meaning it's not always feasible if you have a small budget. You'll also need clean data -- if your reps aren't dedicated to tracking their deal progress and activities, your results will be inaccurate no matter how great your software is.

6. Pipeline Forecasting

This one can take some time -- maybe too much time -- if you don't have a program in place to handle your calculations. It reviews each opportunity currently sitting in your pipeline and calculates its chances of closing based on unique company variables including the rep's win rate and opportunity value.

If your sales team typically closes deals worth between $5,000 and $8,000 within 60 days, all current deals in your team's pipeline would be given a high likelihood of closing. You can then use this data to figure your monthly or quarterly forecast.

This forecasting method relies on your ability to provide high-quality data. If you fudge the numbers or use imperfect data, you'll end up with forecasting that provides zero value.

Make sure your reps regularly enter accurate, timely data into their CRM to glean the most insight from this method.

Sales Forecasting Template

There's a common theme throughout these sales forecasting methods: Data. Even the most lightweight forecasting options (like #3, intuitive forecasting) relies on knowing how many opportunities are in each rep's pipeline and their project likelihood of closing.

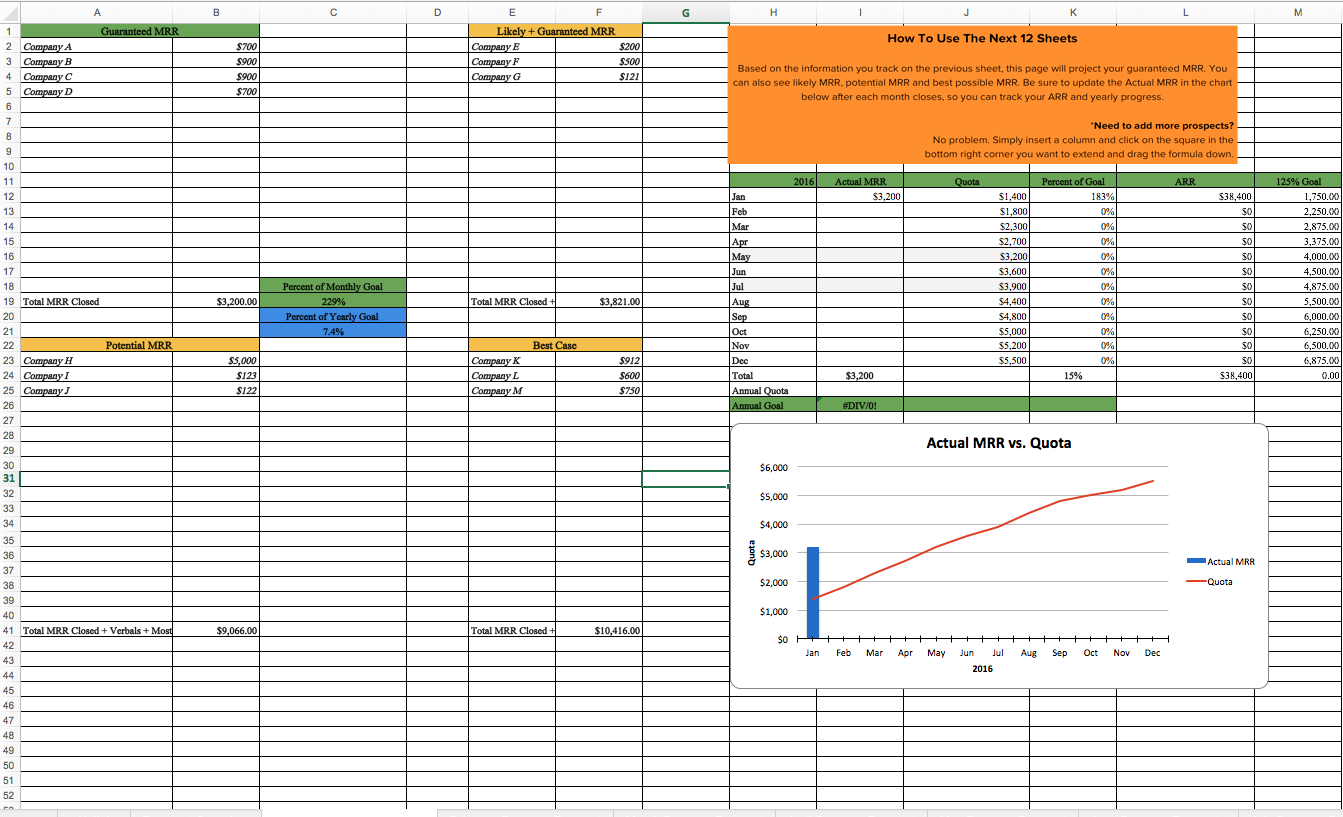

To keep track of all these details, you can use a free sales forecasting template. We've created a sales pipeline tracker that includes:

- A spreadsheet for tracking which deals are guaranteed, likely, potentially, and unlikely to close this month

- A monthly revenue forecast that automatically updates with the information you entered in the first spreadsheet

- A yearly goal tracker so you can monitor your progress

This sales forecasting template is ideal when you're just starting out. However, if your company is more established, consider using a CRM instead. A CRM will calculate all of the above on its own -- so you don't need to lift a finger.

Sales Forecast Example

Here's what the template looks like in action for the month of January:

Try HubSpot's free CRM. Not only will it keep track of your actual and predicted revenue, it automatically logs every interaction with prospects -- emails, calls, and social media -- making your ability to gauge the likelihood of a deal closing even more accurate.

With a thoughtful sales forecasting strategy, you can be ready for the future -- whatever it brings. And get more simple strategies for creating a better sales forecasting model here.