When you're growing and scaling a business, two numbers are more important than anything else:

- How much it costs to acquire a new customer (or "CAC")

- That customer's lifetime value -- how much they'll spend with you over their lifetime (or "LTV")

If your customers are unhappy, you might be in trouble. But if you've invested in their experience, you're well-poised to grow from their success. When you have a base of successful customers who are willing and able to spread the good word about your business, you create a virtuous cycle.

Happy customers transform your business from a funnel-based go-to-market strategy into a flywheel. Through promoting your brand, they're supplementing your in-house acquisition efforts. This creates a flywheel where post-sale investments like customer service actually feed "top of the funnel" activities. Buyers trust people over brands, and brands are getting crowded out of their traditional spaces, so why throw more money at the same go-to-market strategy when you could activate a group of people who already know and trust you?

Buyers trust people over brands, and brands are getting crowded out of their traditional spaces, so why throw more money at the same go-to-market strategy when you could activate a group of people who already know and trust you?

How to Improve Customer Acquisition

Customers are a source of growth you already own, and a better and more trusted way for prospects to learn about your business. The happier your customers, the more willing they are to promote your brand, the faster your flywheel spins, and the faster your business grows. Not only is this the right thing to do by your customers, it's the financially savvy thing to do for your business. It's a win-win-win.

At some point, your acquisition math will break.

More and more businesses are moving to a recurring revenue, or subscription-based model.

A recurring revenue model means customers pay a monthly fee for membership or access to products. A recurring revenue model makes it easy to project expected revenue over a set period of time. Understanding how money moves in and out of the business makes headcount planning, expansion planning, and R&D efforts far easier.

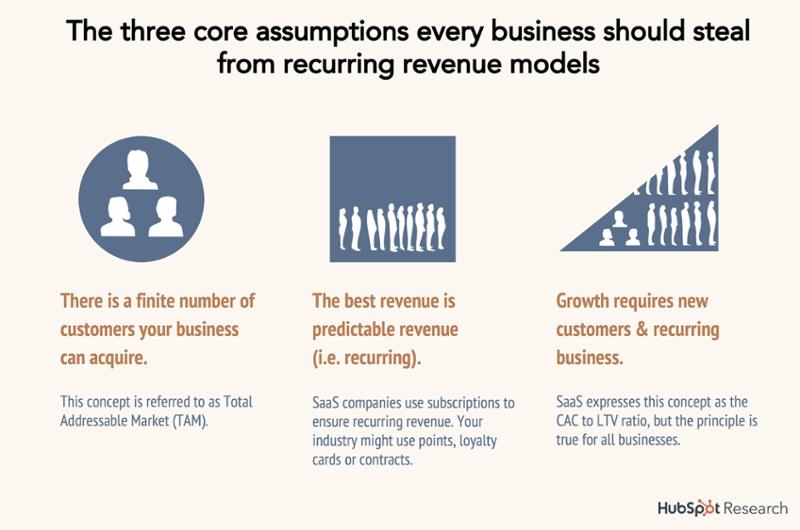

Luckily it doesn't matter if your company is subscription-based or not -- a recurring revenue model contains lessons that apply to all businesses. Before we dive in, there are three core assumptions this model relies on.

First, every business has a defined total addressable market, or TAM. Your TAM is the maximum potential of your market. It can be bound by geography, profession, age, and more -- but in general, every product serves a finite market.

Second, every company aims to create repeat customers -- not just subscription-based ones. All of the examples below are businesses that benefit from recurring revenue, even if it's not formalized through contracts or subscription fees:

- A beauty products store where customers typically purchase refills once every three months

- A hotel chain that becomes the default choice for a frequent traveler

- A neighborhood restaurant that's cornered the market on Saturday date nights

Third, the key to growth is to retain the customers you already have, while expanding into the portion of your TAM that you haven't won yet.

The easiest way to understand why thinking about your business like a subscription-based company does is valuable is to walk through the following hypothetical example -- let's call it Minilytics Inc.

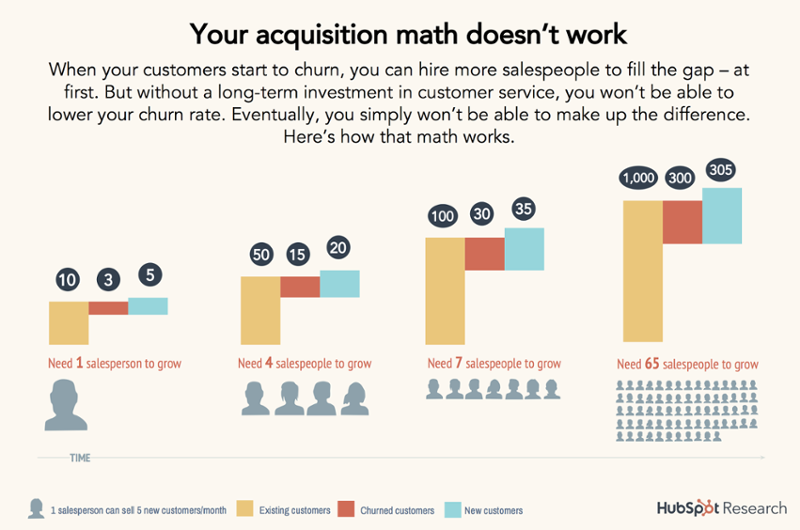

Minilytics starts with a customer base of 10 people, and a churn rate of 30% -- meaning three of their customers will not buy from them again. Each of Minilytics' salespeople can sell five new customers per month. Because Minilytics' customer base is so small, they only need to hire one salesperson to grow.

Fast forward several months, and Minilytics now has 50 customers, 15 of whom churn. To grow, Minilytics' CEO has to bring on three more salespeople, who create additional overhead cost -- their salaries.

You can probably see where this is going. At 100 or 1,000 customers, Minilytics' CEO simply cannot hire enough salespeople to grow. The sheer cost of paying a staff to simply maintain a business that's losing 30% of its customers each month will shutter most businesses on its own.

While Minilytics is struggling to plug the leaks in its business, something else is happening that will tank the company -- even with an army of salespeople.

Remember TAM? While Minilytics' CEO was hiring salespeople to replace churned customers, the company was also rapidly burning through its TAM. Generally, customers that churn do not come back -- it's hard enough to gain a consumer's trust. To break trust through a poor experience, then try to rebuild it, is nearly impossible.

Even if Minilytics is able to afford a rapidly expanding sales team, it's been rapidly churning through its TAM. Eventually, Minilytics will run through its entire total addressable market -- and there will be no room to grow.

Luckily, Minilytics isn't destined for this fate. Let's rewind to that first month and explore what they could have done differently.

Building a good customer experience is the foundation of growth.

Growing a sustainable company is all about leverage.

In plain English, if you can identify the parts of your business model that require great effort but provide little reward, then re-engineer them to cost you less effort or provide more reward, you've identified a point of leverage.

Most companies hunt for leverage in their go-to-market strategy, which usually involves pouring money into marketing or sales efforts. Customer service, customer success, customer support -- or whatever you call it (at HubSpot, we have a separate team dedicated to each function, but we're the exception) -- has traditionally been viewed as a cost center, not a profit center.

It's not hard to understand why. The ROI of sales and marketing investment is immediately tangible, while investment in customer service is a long game.

But most companies mistakenly try to optimize for fewer customer interactions, which just means issues don't get addressed. Because they're thinking short-term, it ends up costing them dearly in the long term. Too many businesses think once a sale is made and the check's cleared, it's on to acquire the next new customer.

That doesn't work anymore. The hardest part of the customer lifecycle isn't attracting their attention or closing the deal -- it's the journey that begins post-sale.

Once your customers are out in the wild with your product, they're free to do, say, and share whatever they want about it. Coincidentally, that's when many companies drop the ball, providing little guidance and bare-bones or difficult-to-navigate customer support. This approach, quite frankly, makes no sense.

Think about it this way: You control every part of your marketing and sales experience. Your marketing team carefully crafts campaigns to reach the right audiences. Your sales team follows a playbook when prospecting, qualifying, and closing customers. Those processes were put in place for a reason -- because they're a set of repeatable, teachable activities you know lead to consistent acquisition outcomes.

Once a customer has your product in their hands, one of two things will happen: Either they will see success from using it, or they will not. If they're a new customer or first-time user, they might need help understanding how to use it, or want to learn from other people who have used your product, or want recommendations on how best to use it. Regardless of what roadblocks they run into, one thing is for sure: There's no guarantee they'll achieve what they want to achieve.

This is a gaping hole in your business. No one is better positioned to teach your customers about your product than you. No one has more data on what makes your customers successful than you. And no one stands to lose more from getting the customer experience wrong than you.

Let me say that one more time, because it's important: Nobody has more skin in the game than you. In our survey, 80% of respondents said they'd stopped doing business with a company because of a poor customer experience.

If your customers are dissatisfied, they can -- and will -- switch to another provider. There are very few businesses in today's market with no competitors. Once you lose a customer, you are most likely not getting them back. If you fail to make your customers successful, you will fail too.

Not convinced? Here's another way to think about how to best allocate money between marketing, sales, and customer service.

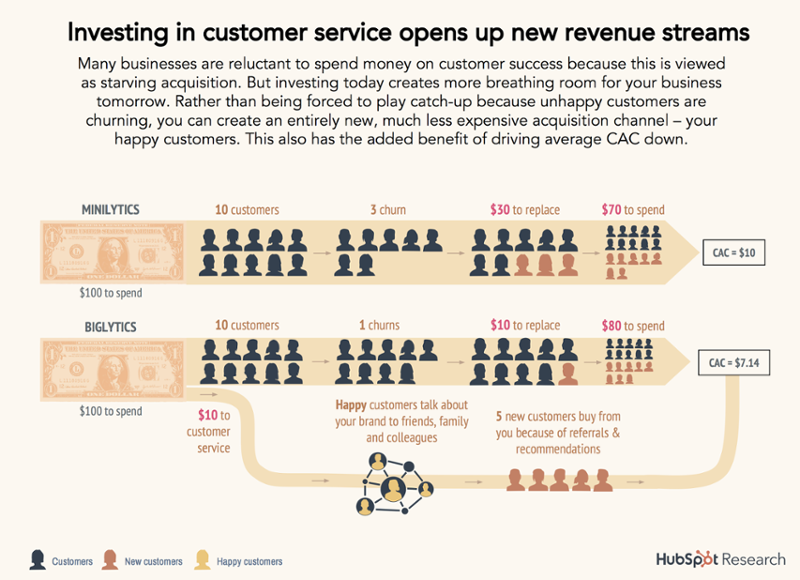

Consider Minilytics and Biglytics, both with a CAC of $10 and a budget of $100.

Minilytics hasn't invested in a well-staffed or well-trained customer service team, so their churn rate is 30%. Three customers churn, so they spend $30 replacing them. All of the remaining $70 is spent on acquisition, ending with 17 customers.

At Biglytics, things are different. Customer service isn't the biggest part of the budget, but the team is paid well, trained well, and knowledgeable enough to coach customers who need help.

Because Biglytics has proactively spent $10 of your budget on customer service, their churn rate is much lower, at 10% (for the record, a churn rate of 10% is terrible -- we just chose it to keep numbers simple). Biglytics replaces their single churned customer for $10 and spends the remaining $80 on eight new customers, netting out at 18 customers.

A one-customer difference doesn't seem significant. But that $10 Biglytics invested in their customer service team has been working in the background. Customers they brought on last year have seen success with the product because of great customer service, and have been talking Biglytics up to their friends, family, and colleagues. Through referrals and recommendations, Biglytics brings on five more customers without much extra work from the sales team.

This means Biglytics has not only brought on six more customers than Minilytics in the same timespan, it also brings down their average CAC to $7.14.

Which company would you rather bet on? I'm guessing it's Biglytics.

This is why investment in customer service is so powerful. Taking the long view enables you to grow more. It costs anywhere from 5 to 25 times more to acquire a new customer than to retain an existing one. Prioritizing short-term growth at the expense of customer happiness is a surefire way to ensure you'll be pouring money into the business just to stay in maintenance mode.

A version of this blog post was originally published on HubSpot Research.