Since January, Jen Coleman has kicked her videoconferencing habit, flying from her home in London, first to Miami and later to Melbourne, to see clients in person—and win a renewed contract for her company. “I’ve spent two years on Zoom,” says Coleman, 33, who helps Australian phone company Optus manage its relationship with Formula One driver Daniel Ricciardo. “It’s just not the same.” Coleman’s experience is just one small piece of evidence pointing to a rebound in business travel. Airlines’ early fears that videoconference applications such as Zoom, Teams, and Skype might keep lucrative business travelers home permanently are subsiding as governments ease border restrictions and executives rediscover the commercial value of human contact. Data from four top companies that manage corporate travel show that two years after Covid-19 pushed aviation to the brink, premium-class cabins are filling up again. The pessimists “were wrong,” says Andrew Crawley, chief commercial officer for American Express Global Business Travel, the industry leader. “Business travelers are coming back.”

That will be key to reviving the airlines. Corporate clients typically deliver bigger returns than those packed in coach, spending more than $1 trillion on travel in 2019, according to the World Travel & Tourism Council. Amex GBT’s business has rebounded to 61% of its pre-pandemic level from just 25% at the peak of the omicron outbreak. CWT, a business-travel company that provides services to one-third of S&P 500 members, says bookings today exceed half of normal levels, up from as little as 20% at the start of this year. Technology, retail, government, and defense sectors are leading the recovery, CWT says, and banks are catching up. FCM Travel, which has a presence in almost 100 countries, says business is at 80% of the 2019 pace and in some places has edged ahead of pre-pandemic levels. “It’s coming back much stronger than anyone anticipated,” says Bertrand Saillet, managing director of the company’s Asian operations.

While it remains to be seen whether the recovery can be sustained—executives may ultimately take fewer business trips than previously once the initial euphoria of a return to travel wears off—the pace of the rebound is shoring up confidence at airlines as they deploy fleets and map out their post-pandemic networks. The Bloomberg World Airlines Index has climbed about 50% from a May 2020 low. Delta Air Lines Inc. says domestic business bookings have reached 70% of 2019’s level, and almost all its corporate clients expect to travel more in the current quarter. United Airlines Holdings Inc. says business travel across the Atlantic already exceeds what it saw in 2019. “I think this quarter we’ll be able to put to bed the whole question: ‘Is business travel coming back?’” United Chief Executive Officer Scott Kirby told Bloomberg Television. “That business travel is recovering so rapidly makes us feel really, really confident.”

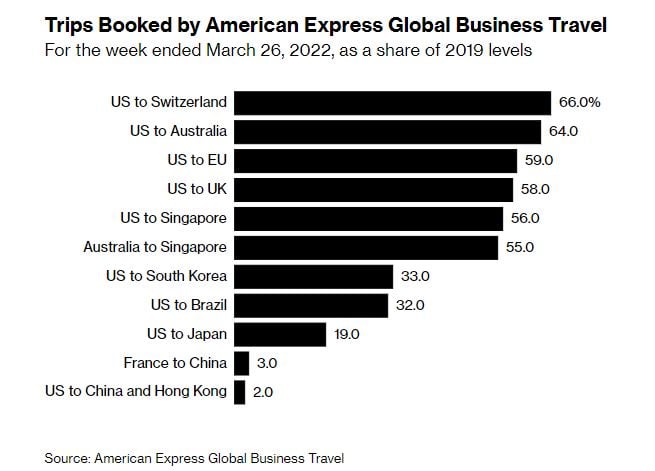

Trips Booked by American Express Global Business Travel

For the week ended March 26, 2022, as a share of 2019 levels

The picture isn’t uniform. The rebound is anemic in China, which is still locking down entire cities in a bid to stamp out Covid, and Hong Kong, where foreign visitors must quarantine on arrival. And many of those filling the most expensive seats are leisure travelers who’ve made their way to the front of the plane with loyalty points in pursuit of additional distance from fellow passengers—or perhaps just a bit of pampering after being grounded by pandemic restrictions; it’s unclear whether this will continue once they settle into normal travel routines. “People are prepared to trade up now for space,” Etihad Airways CEO Tony Douglas said on Bloomberg TV, noting that 90% of his business-class seats are filled with leisure travelers. “It’s revenge tourism.”

Some in the business say there’s bound to be a degree of retrenchment after two years of relative success with virtual get-togethers. At the very least, executives will become more selective, ditching marginal trips that let them briefly see colleagues with no immediate, quantifiable payoff, says Keith Tan, CEO of the Singapore Tourism Board: “People do enjoy not having to travel hours and hours and go through jet lag for meetings we now know we can do effectively over Zoom.”

Although online booking service Hotel Planner predicts it will take an additional two years for business travel to fully recover, many executives are making up for lost time. A majority of companies responding to an April survey by the Global Business Travel Association say they’re putting executives back on planes as staff return to the office, and trips are being canceled less frequently. AustralianSuper, the country’s largest pension fund, is dispatching managers worldwide to oversee investments and meet staff. In March, CEO Paul Schroder flew to London, his first foreign jaunt since the pandemic. And in July, the fund’s investment committee will head to the UK on its first post-Covid overseas trip. “We have no alternative but to invest properly in bringing people together,” Schroder says. “There is something special about meeting face-to-face.” —With Keira Wright and Kyunghee Park.

Guest Blogger: Angus Whitley and Danny Lee - https://www.bloomberg.com/news/articles/2022-05-08/business-travel-up-as-people-skip-zoom-for-in-person-meetings